23+ j1 visa tax calculator

For foreign seasonal workers these three figures are zeroes. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Web There are different J-1 visa tax rates depending on factors such as your income.

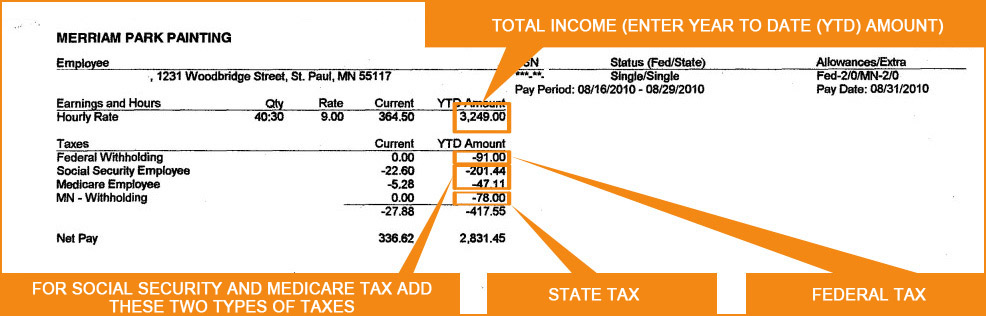

. Web These are usually 62 for Social Security up to 62 for Federal Unemployment and 145 for Medicare. Discover Helpful Information And Resources On Taxes From AARP. Web Make changes to your 2022 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312025.

Ad Filing your taxes just became easier. Web You must figure out your J-1 visa resident status to determine your J-1 visa tax status. Federal Income Tax Rate Gross payment 116279.

Web File Form 8843. Whether you will receive a USA J-1 tax refund depends on the status. All non-residents must pay 10 on any income tax up to 11000.

Web Maya needs to determine whether she meets the Substantial Presence Test. Web All right are reserved J1 Summer Tax Back Inc. As a J-1 visa holder you are considered as a non-resident for the first two years since you entered the US.

Web Our income tax calculator calculates your federal state and local taxes. It doesnt matter if you. TaxAct helps you maximize your deductions with easy to use tax filing software.

Web It depends how long you have been in the US. All J1 visa holders have to file Form 8843 Statement for Exempt Individuals and Individuals with a Medical Condition. Web Web The answer is yes J-1 visa holders can receive tax refunds just like their US.

You are a J-1 visa resident for tax. In other words if you want the student. Federal Income Tax withheld 14 16279.

Web An au pair is always admitted into the United States on a J-1 visa and is not allowed to remain in the United States longer than one year. Web Estimate how much youll owe in federal taxes for tax year 2022 using your income deductions and credits all in just a few steps with our tax calculator. She should start counting days on 01-01-2021 and should count these days as follows.

An au pair must be between. File your taxes stress-free online with TaxAct. Web The answer is yes J-1 visa holders can receive tax refunds just like their US.

First lets cover when you are considered a resident alien. Web W 1000 1-14. Terms and conditions may vary and are subject.

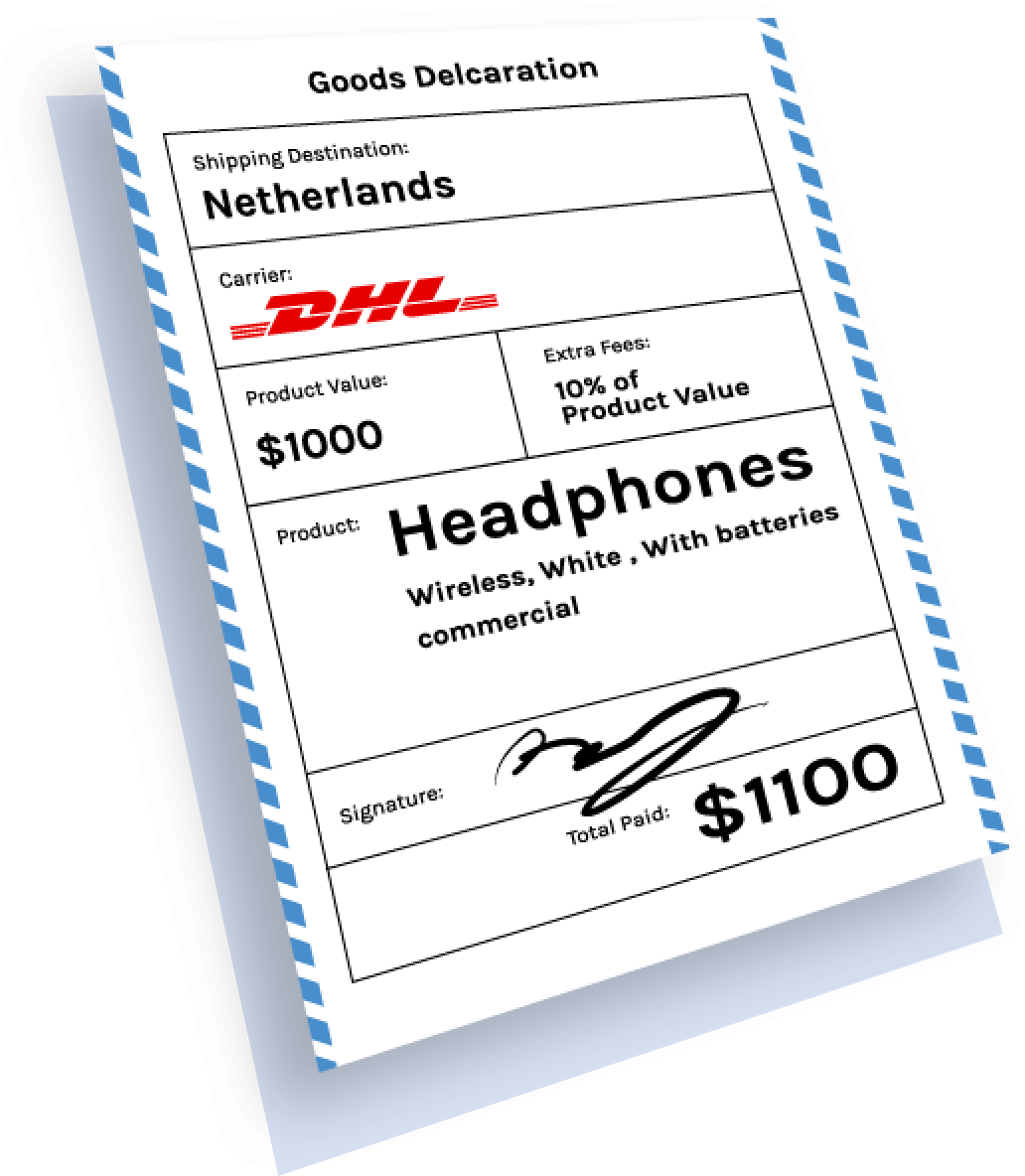

Free Duties And Taxes Calculator United States Easyship

Us Hourly Wage Tax Calculator 2023 The Tax Calculator

Everything J 1 Visa Holders Need To Know About Taxes Nova Credit

How To File J 1 Visa Tax Return 101 Tfx

Places With The Highest And Lowest Income Tax Rate And Take Home Salary Bloomberg

Usa Tax Refund Calculator

.jpg)

What Are J 1 Visa Tax Returns Get Your Questions Answered Here Global Internships

How To Calculate Foreigner S Income Tax In China China Admissions

Important Information Before Traveling

J 1 Visa Tax Exemptions And Tax Treaties Global Internships

Galveston College 2017 2018 Catalog By Galveston College Issuu

Policies 2020 01 14 Pdf Pdf Postgraduate Education Thesis

J 1 Visa Tax Return Information Documents And Application

New York State Student Lower Hudson Regional Information Center

How To File A J 1 Visa Tax Return J1 Visa Taxes Explained 2023

How To File A J 1 Visa Tax Return J1 Visa Taxes Explained 2023

The Complete J1 Student Guide To Tax In The Us